You can keep track of your PAYE liability and record payments within Shape.

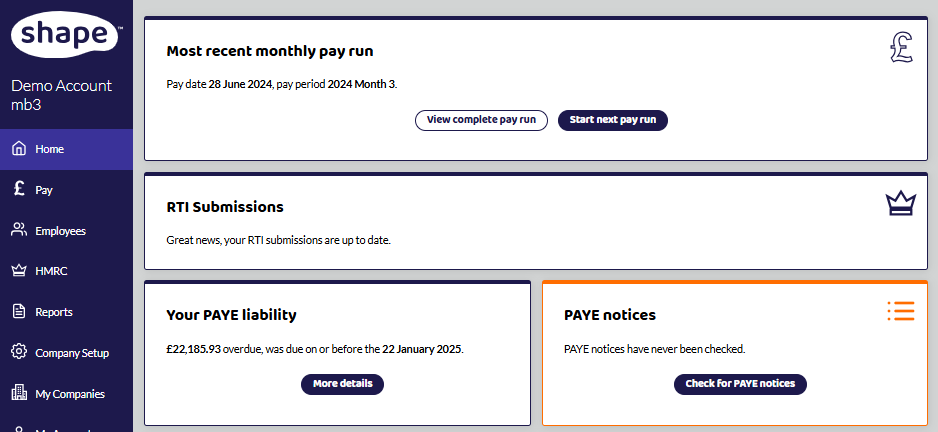

You can find this by selecting More Details within the Your PAYE Liability tile on your home page or HMRC in the side menu.

Review Your PAYE Liability

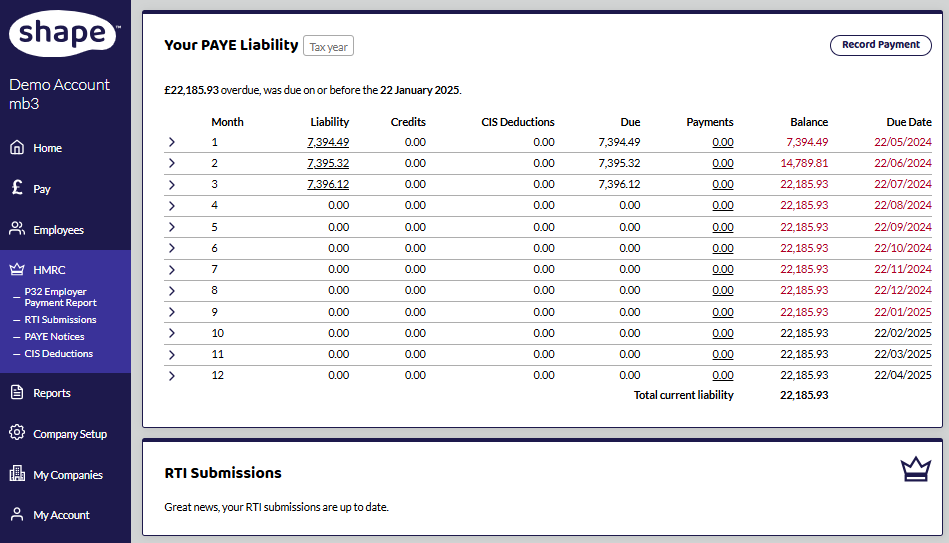

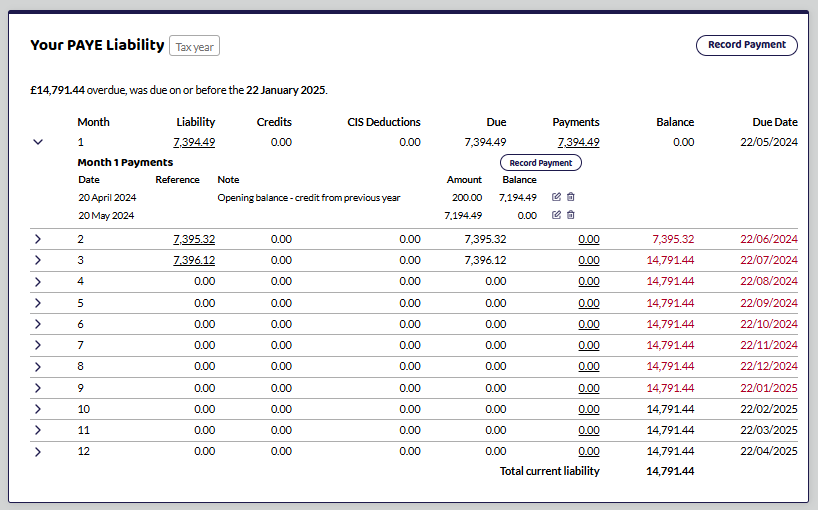

On your PAYE Liability screen, you will find all liability, credits, CIS deductions and payments. If you click the underlined numbers under liability or credits, it will take you to the P32 where you will see the breakdown. If not all pay runs have been completed for that pay period, then it will show that the month has not been completed and that it is a draft calculation.

Liability will be any tax, Employer and Employee NI and apprenticeship levy that the company owes HMRC.

Credits will be the Employment Allowance and any statutory payments that are being reclaimed.

Change tax years - You can also change between tax years by selecting the Tax Year button next to Your PAYE Liability at the top of the page.

Paying your PAYE bill to HMRC

You can find out more on paying your PAYE bill here: Pay employers' PAYE

Record Payment to HMRC

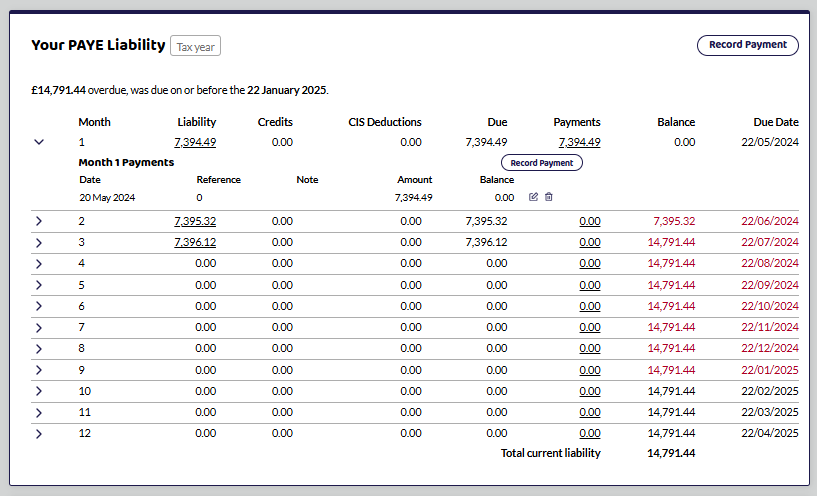

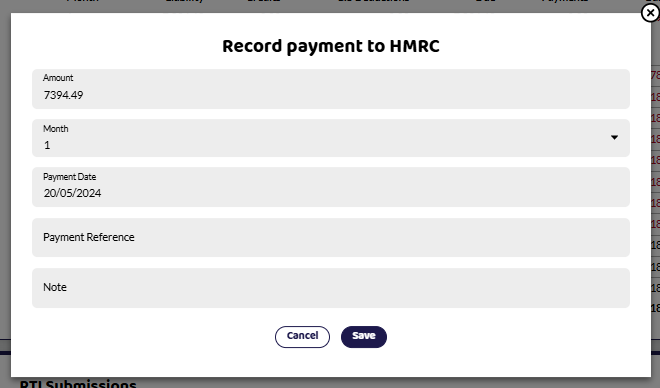

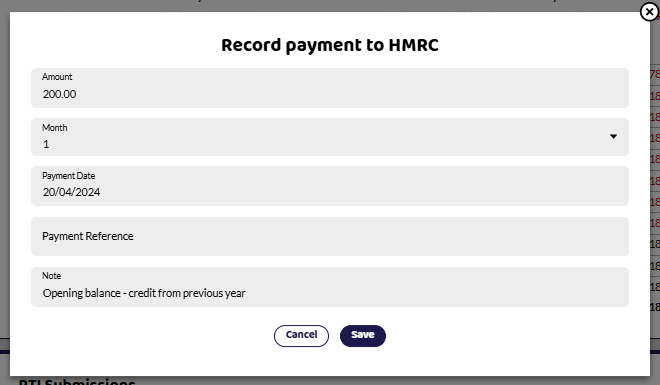

You can record a payment you have made to HMRC in two ways. By clicking the Record Payment button at the top of the screen or selecting the arrow next to the month and you'll find a record payment against that month.

If you select record payment within the month, it will automatically include the amount due for that month.

Payment Reference - This is the information you would have used within your banking if you pay HMRC by BACS or bank transfer. You will need to use your 13-character accounts office reference number.

Paying HMRC Early or Late - You need to add extra information to the accounts office reference number. Follow the link below under HMRC - Paying Employers' PAYE to find the correct reference to use. You can read about using the correct references in our blog 'Do you know what reference you should be using when making PAYE bank payments to HMRC?'

Notes - This allows you to make any notes, for example how you made the payment or who made it.

Have a credit with HMRC from the previous tax year

You may have credit with HMRC that is on your PAYE account. To record this, select the Record Payment button at the top of the screen.

You can add a note to explain - for example, opening balance - credit from previous year.

This shows the credit has been applied to the account and the company does not owe HMRC anything. Future liability will be offset against this payment.

Migrated to Shape Payroll mid-year

You may owe HMRC and need to keep track when migrating to Shape. As above, put in a negative value and you can write a note for your records.

Editing or deleting payments

You can edit or delete the record by selecting the icons next to the payment information.

HMRC Further Guidance

Paying Employers' PAYE - Find out how to make payments to HMRC and using the correct reference on bank payments.

You paid HMRC the wrong amount - What to do if you've paid HMRC the wrong amount.