The starter wizard is used to register both existing employees if you are migrating and also any new starters.

You need to collect as much information from the employee before starting the starter wizard.

Employee Full Name,

Address,

Date of Birth,

Gender,

National Insurance Number,

P45 or Starter Checklist if a new starter or;

P11 or Full Payment Summary (FPS) if migrating from another software provider.

Employee identity details should be verified from an official source. A birth certificate, passport, driving licence, or official documents from HMRC or the DWP.

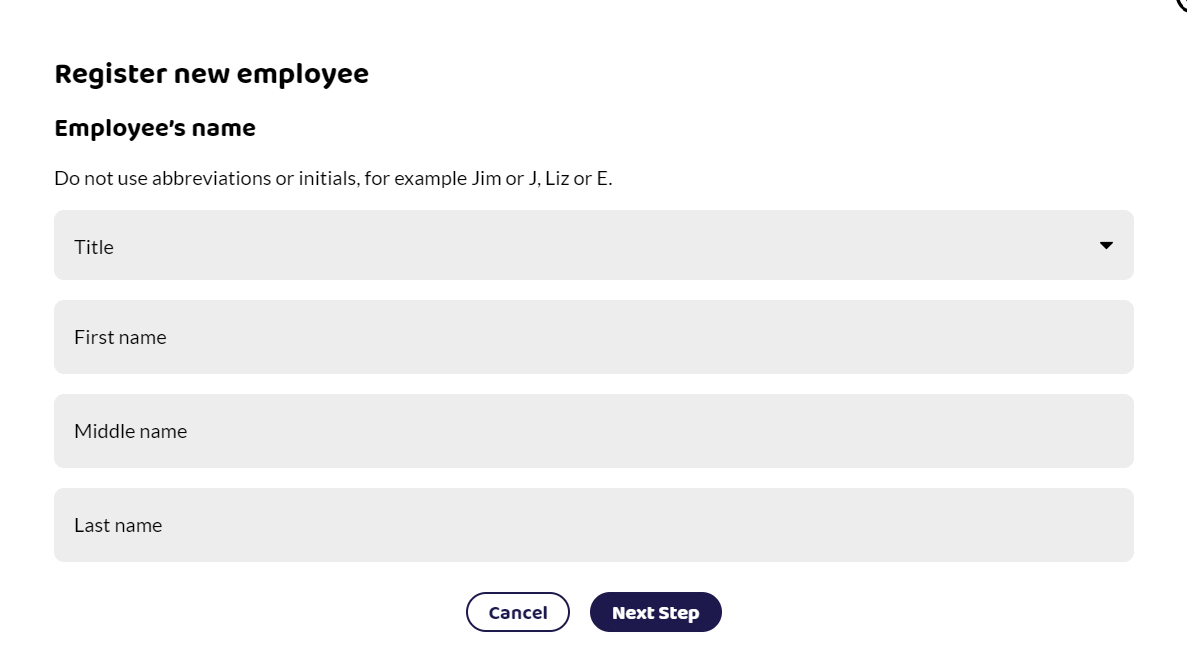

Employee Name

Title

If known.

First Name

Use first full forename.

Do not use nicknames or familiar names. Do not include extra information such as 'staff' or 'temp'.

Middle Name

Enter full forename.

Do not use nicknames or familiar names.

Surname

Required for FPS. Make sure it is spelled correctly.

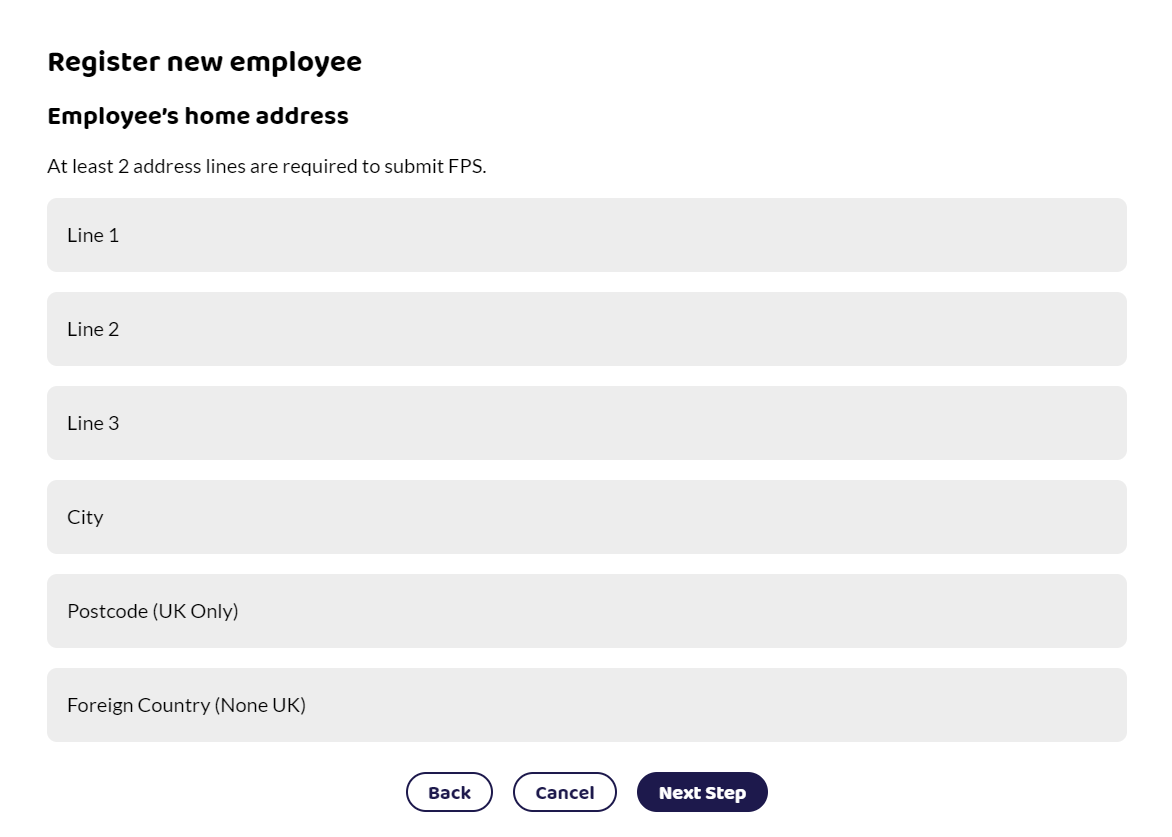

Address

At least 2 lines of address are required.

Postcode

Enter a valid UK postcode. Do not enter a foreign country, Channel Islands or Isle of Man information here.

Foreign Country

Record here if your employee's address is outside the UK, Channel Islands, and Isle of Man.

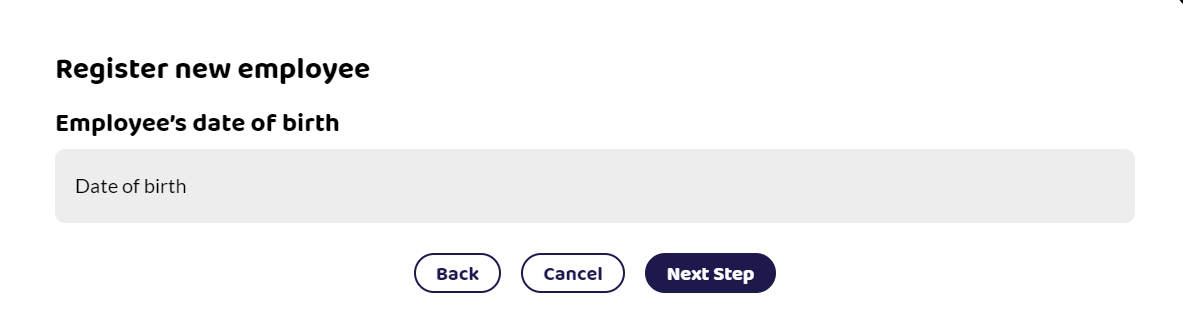

Date of birth

Make sure you enter the correct date of birth. If you have entered the wrong date of birth, the wrong national insurance category may apply to the employee.

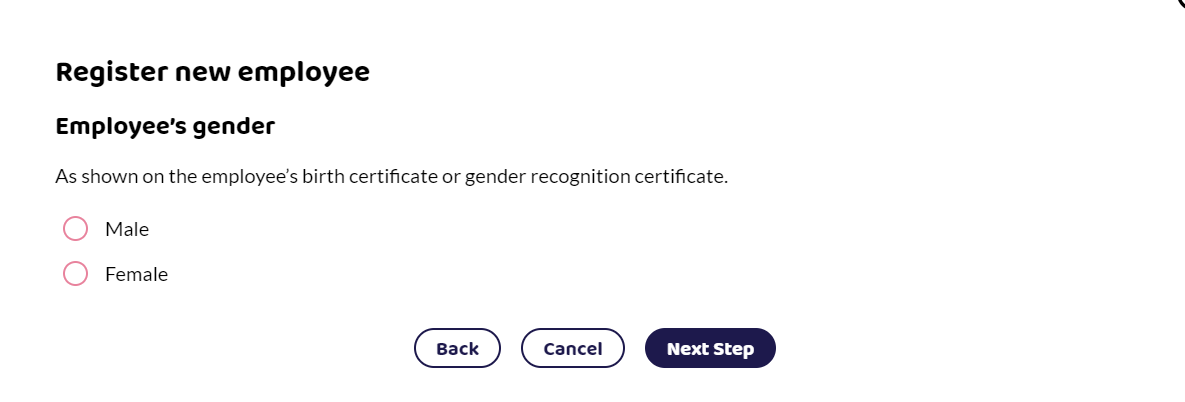

Gender

Male or Female as shown on the employee's birth certificate or gender recognition certificate. It is required for FPS submissions. Applying the wrong gender can affect national insurance contributions and statutory payments if incorrectly selected.

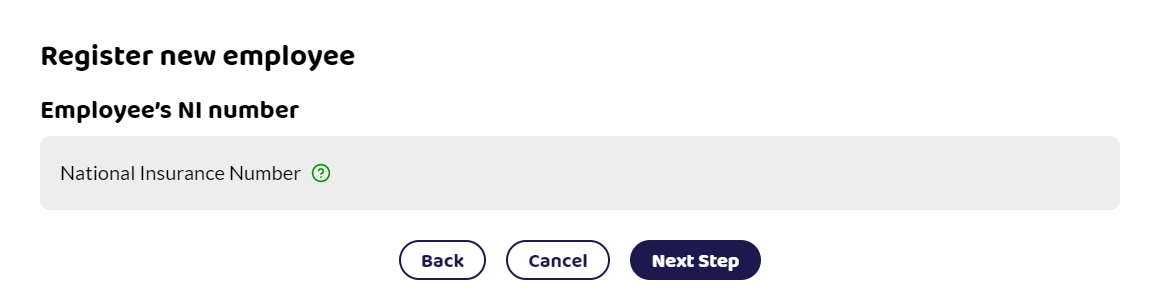

National Insurance Number

Your employee should supply you with their National Insurance Number (NINO).

A national insurance number has two letters, followed by six numbers, followed by one letter A, B, C, D, or a space.

If the employee is waiting for their national insurance number, you should leave the box empty. Once received, add the NINO by editing the tax settings on the employee's page.

Within Shape, if the NINO is left blank, there will be a flag on both the Employees card and in the Pay Run to show that you need to add it.

Do not make up a number, use temporary numbers, or use someone else's number. Making up a NINO will duplicate records within the HMRC system and cause issues for both the employee and employer.

Once supplied you can edit the tax settings within the employee details page.

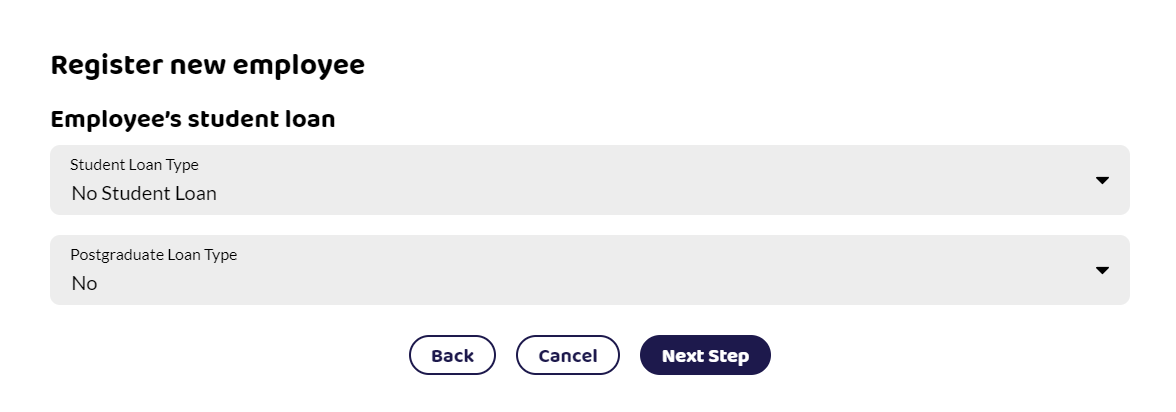

Student Loan and Postgraduate Loan Type

Add the student loan type or select Yes for the Postgraduate loan if indicated on the P45 or Starter Checklist. The software will be able to deduct the correct amounts from the employee if they exceed the earnings thresholds.

Employees can have both a student loan and a postgraduate loan. If the student loan box on the P45 is ticked and the employee does not know which plan they are on, you should select Plan 1. HMRC will send notification if a different plan is required.

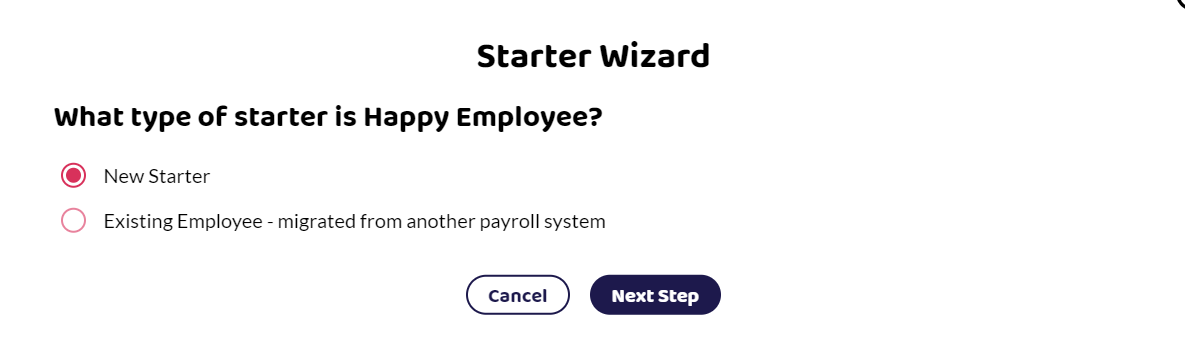

New Starter or Existing Employee

Once you get here, you need to select which type of employee they are. Choose from the following and read the article to find out more about what information to add: