You need to find all the information about your Smart pension scheme before you add it to Shape. Log into your Smart Pension Account where you should be able to access the information needed.

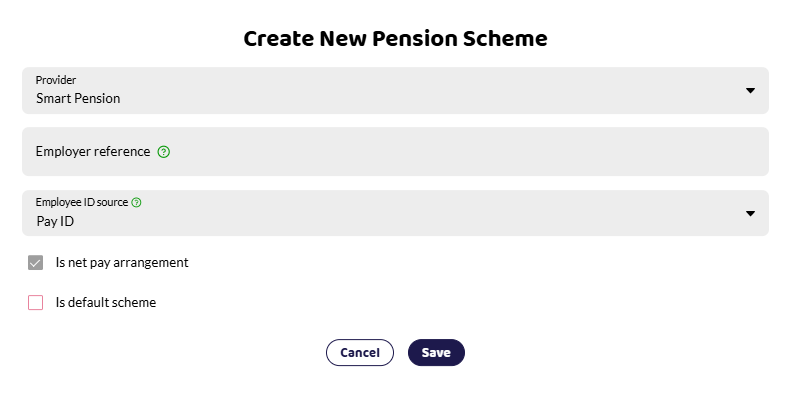

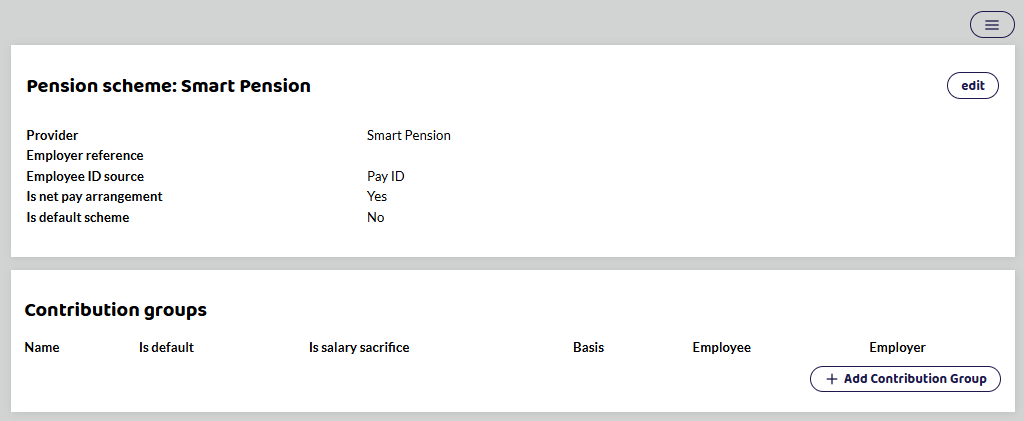

Provider and Pension settings

Employer Company ID - Enter this into the Employer Reference section. This can be found in your Smart Pension account and is normally a variation on your name. However if your scheme was set up before 2016, it might be a string of numbers.

Smart Pension is a NET pay arrangement pension by default. This cannot be removed.

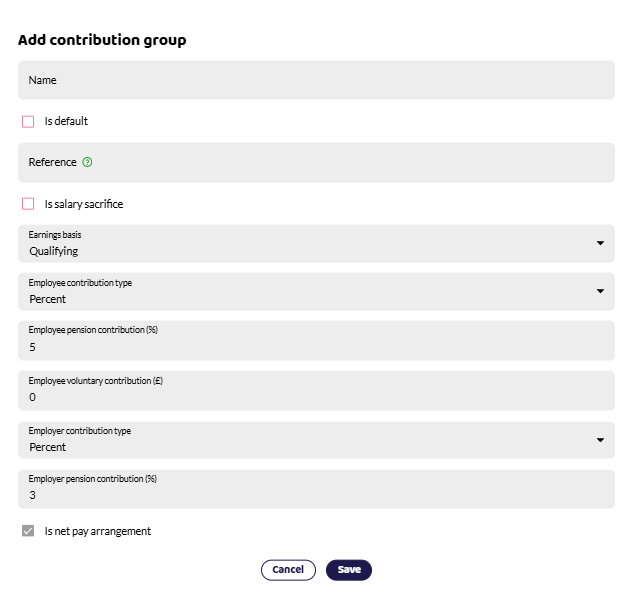

Add a Contribution Group

Earnings basis - qualifying or pensionable.

Contribution type - Fixed or percent.

How much the employee and employer is contributing.

Smart is a Net Pay arrangement pension scheme and so the box is ticked by default. A net pay arrangement means that payments are taken from the gross salary before income tax.

Is it a salary sacrifice scheme?

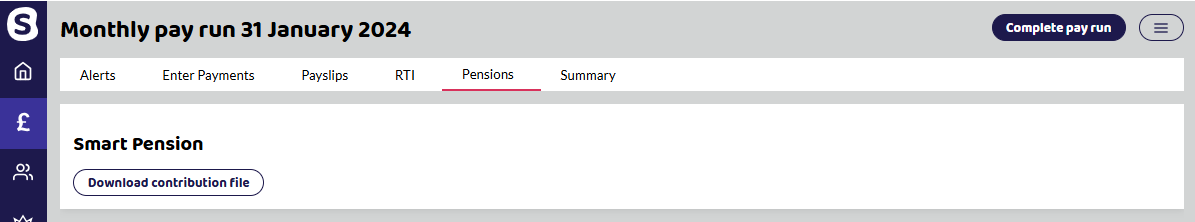

Upload PAPDIS CSV to Smart

On the pension tab within each pay run, there will be a Download Contribution File. This can then be uploaded into Smart Pension, saving you time.

Do not open the CSV, especially if you have excel on your computer as this could change the formatting of the file and cause the file to be rejected when you upload it into Smart Pension.

If you do open the file in excel, do not save the file. If you do, excel may change the date format to DD/MM/YYYY. Any dates in the file need to be changed to show YYYY-MM-DD.

Smart has a guide to show you where you upload your contribution schedule: Upload CSV to submit contributions.

Smart Pension Further Guidance

Tax and your pension - What are tax relief and net pay arrangements

Salary sacrifice pensions - Link to employer guidance at the bottom of the article.