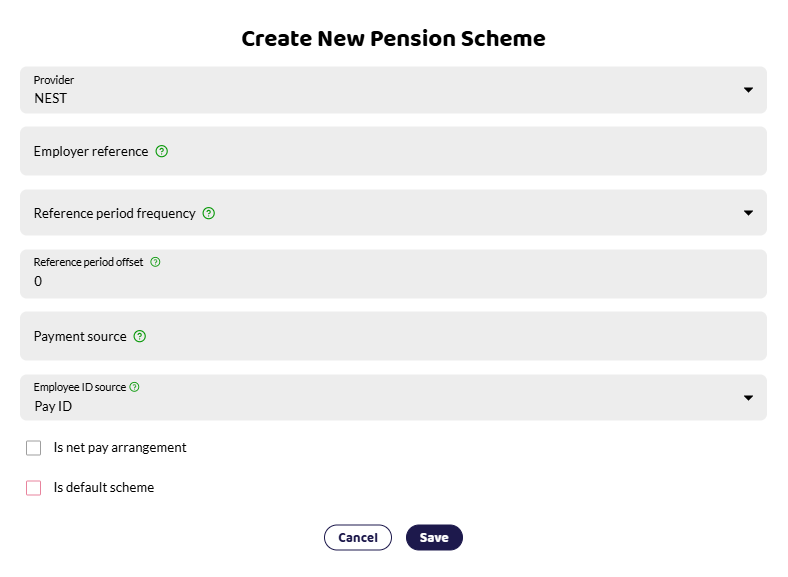

You need to find all the information about your NEST pension scheme before you add it to Shape.

Provider and Pension settings

Employer reference - This can be found on your NEST dashboard and is also known as NEST emplyer ID - it normally has the following format - EMPnnnnnnnnn. For example - EMP123456789. The EMP should always be entered as capitals.

Pay reference period - tax month or calendar month.

Payment Source - Name of the payment source

Contributions

Earnings basis - qualifying or pensionable.

Contribution type - Fixed or percent.

How much the employee and employer is contributing.

NEST is a relief at source (RAS) scheme. NEST claims the 20% tax the employee pays back from HMRC and so can not be set up as a net pay arrangement. Shape automatically calculates the tax relief.

Is it a salary sacrifice scheme?

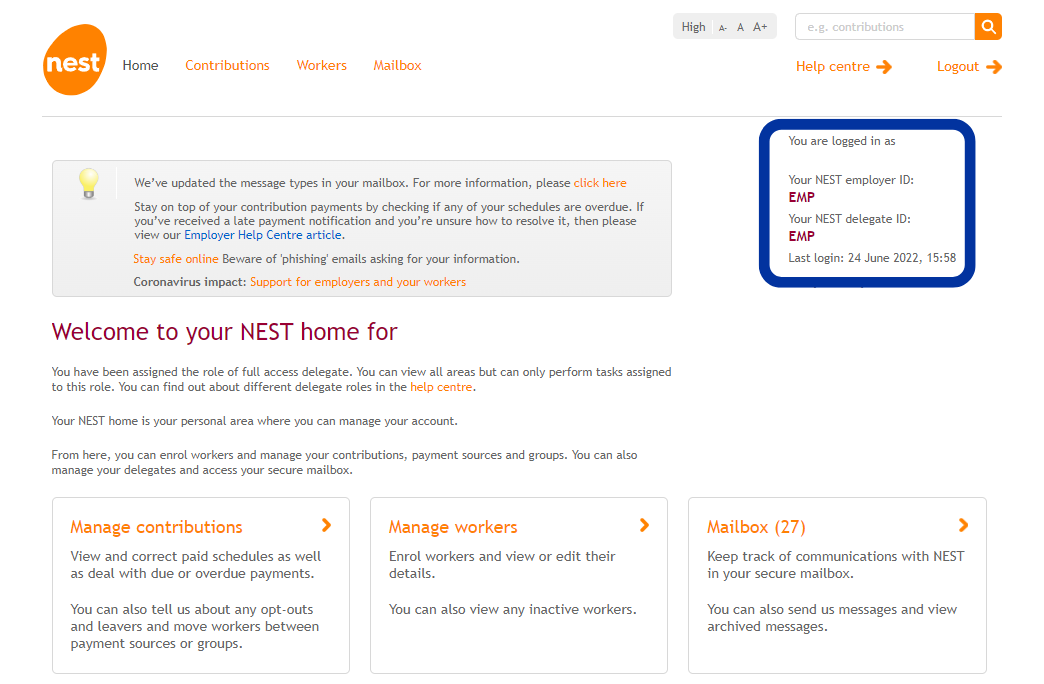

Finding the information in NEST

You can find out your scheme details by logging into your NEST account.

Employer Reference - NEST Employer ID

Find this on your homepage, right-hand corner. There should be your name and underneath the NEST Employer ID: EMPnnnnnnnnn.

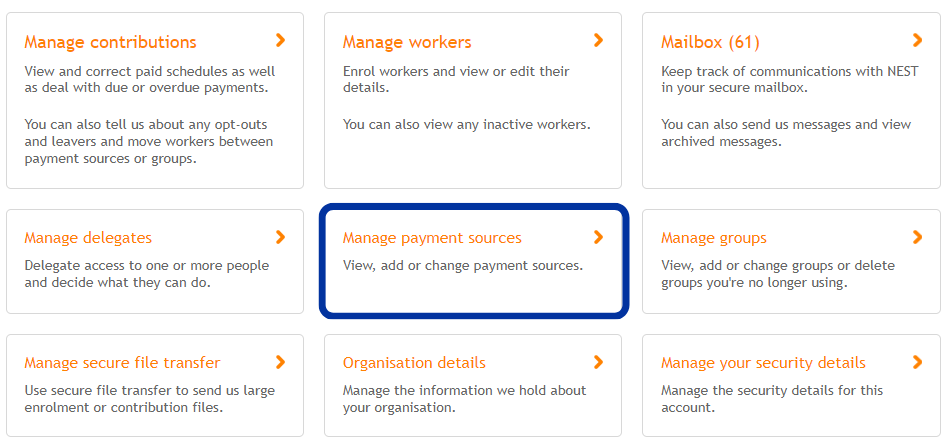

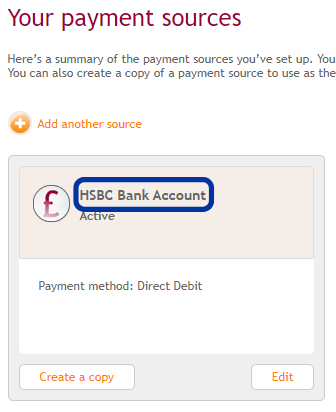

Payment Source

To find the name of your payment source, select Manage payment sources.

Your payment source in Shape must match exactly as it is in NEST next to the £ sign.

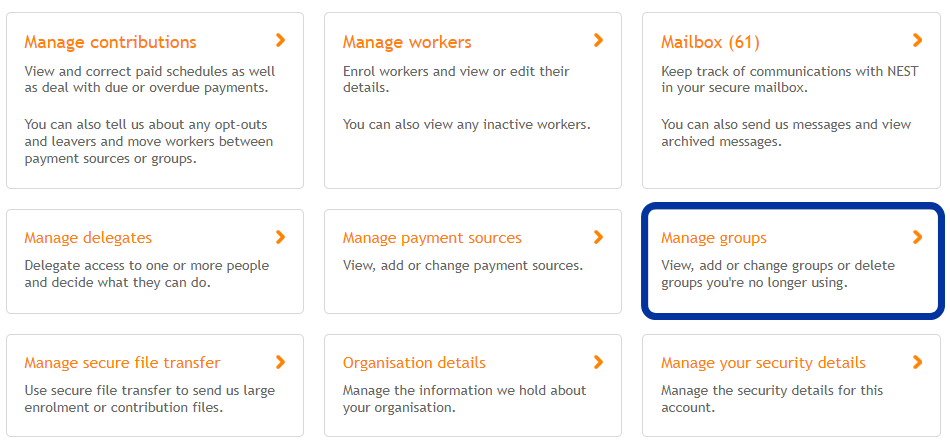

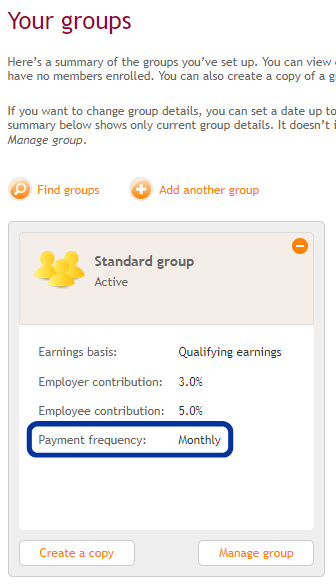

Pay Reference Period and Contributions

To find your payment reference period and contributions go to Manage Groups.

The pay reference period is important as this needs to match with what NEST are expecting. For example, Monthly would refer to calendar months and Tax monthly refers to the 6th - 5th, lining up with the tax calendar.

Example above is a standard scheme that shows the earnings basis is Qualifying and employee contribution is 5% and Employers 3%.

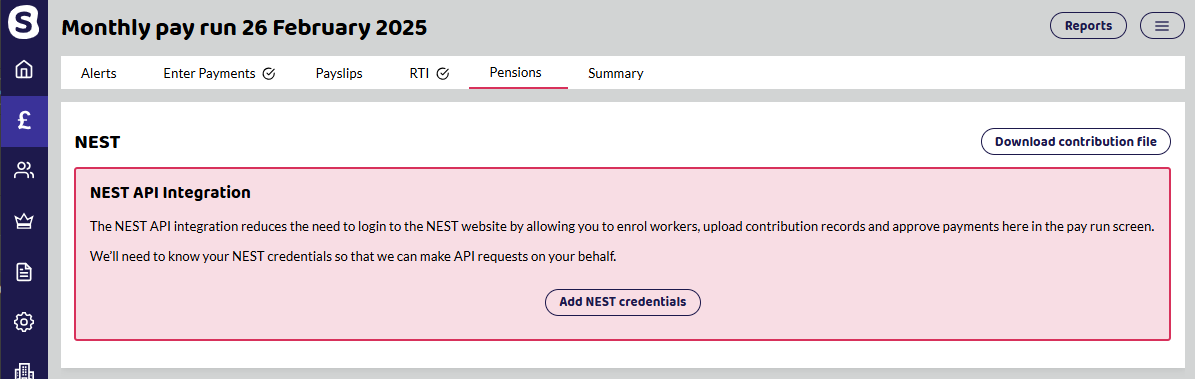

Upload CSV to NEST

On the pension tab within each pay run there will be a Download Contribution File. This can then be uploaded into NEST, saving you time.

Do not open the CSV, especially if you have excel on your computer as this could change the formatting of the file and cause the file to be rejected when you upload it into NEST.

If you do open the file in excel, do not save the file. If you do, excel may change the date format to DD/MM/YYYY. Any dates in the file need to be changed to show YYYY-MM-DD.

NEST have a guide here to show you where you upload your contribution schedule. Upload CSV to submit contributions.

NEST API Integration

Now available for paid subscriptions. The NEST API Integration reduces the need to login to the NEST website by allowing you to enrol workers, upload contribution records and approve payments within the pay run screen.