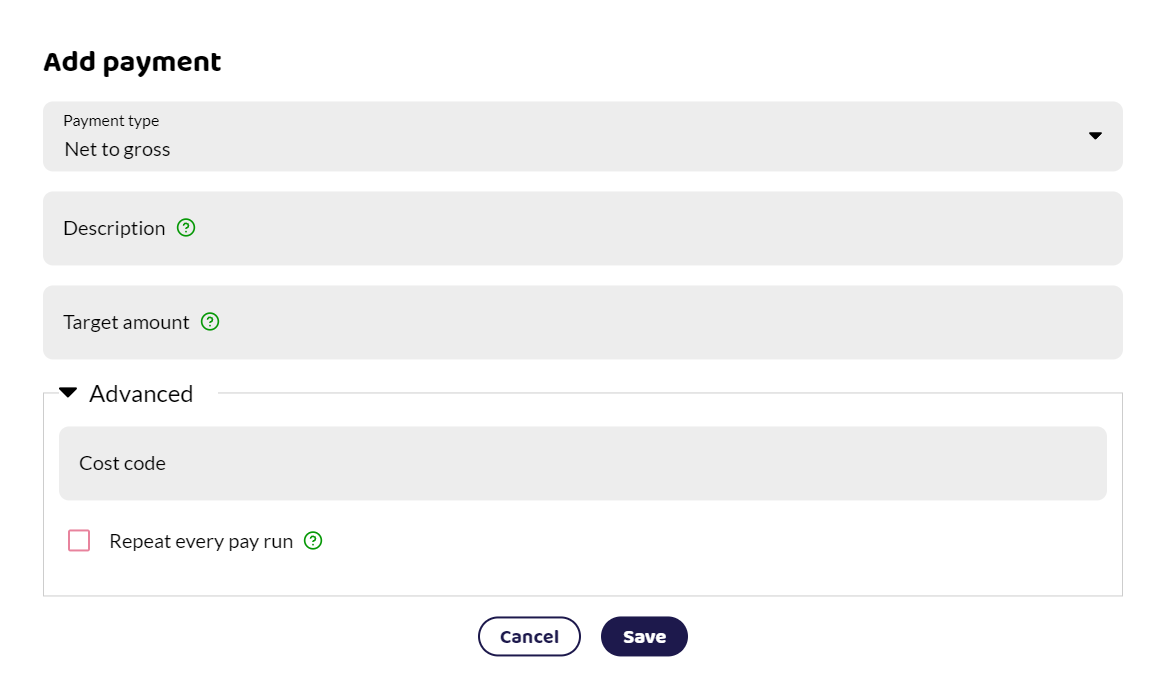

Net to gross payments are when you want to pay an employee a fixed net amount that takes into account any tax, NI, pension, and student loan deductions and so the payment is 'grossed up'.

Net to Gross Example

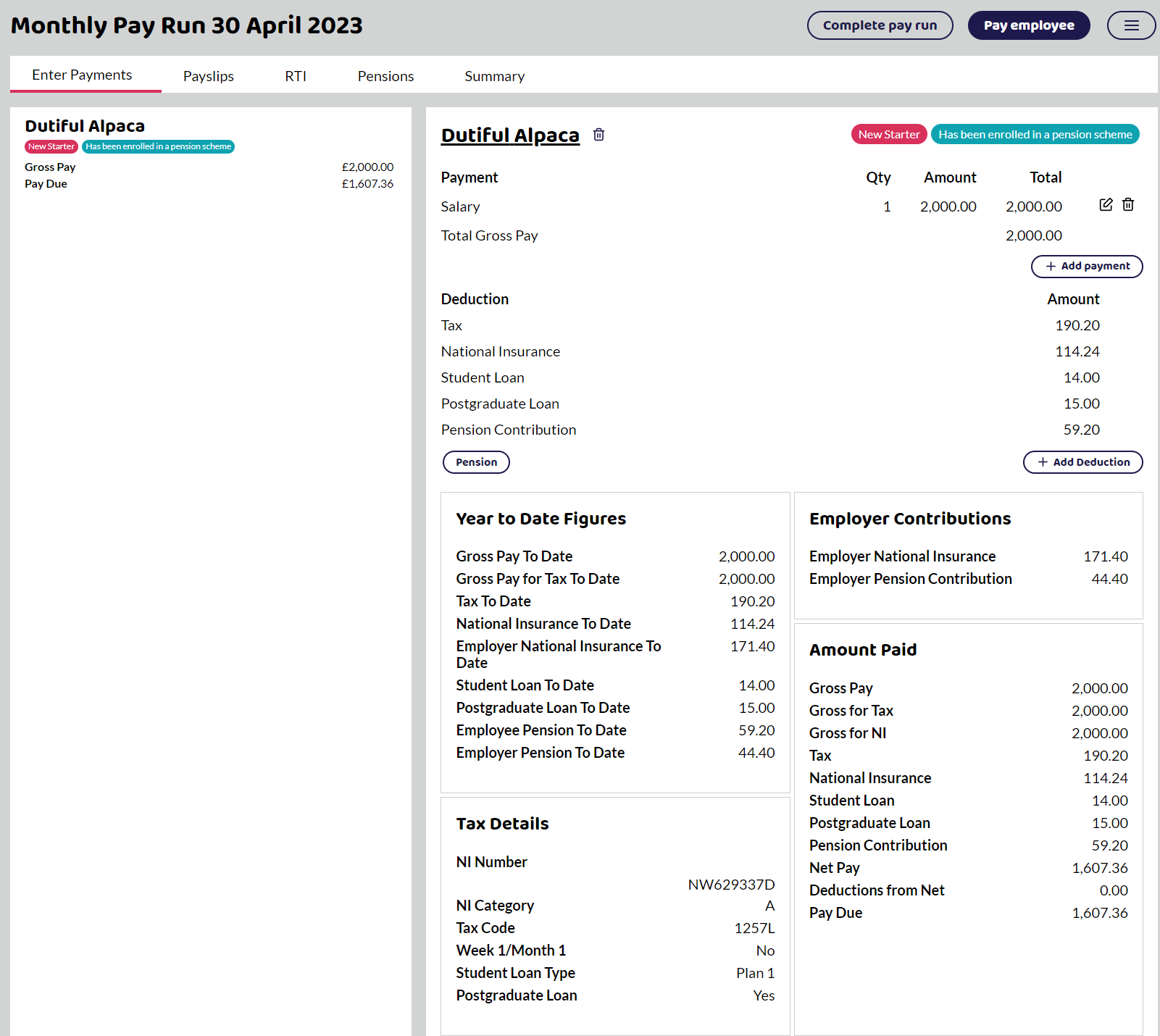

Employee wants to be paid £2000 net pay every month. The employee is on a standard tax code and NI category A. He has a student loan, postgraduate loan and contributes to a NEST pension.

Normally a gross pay of £2,000 would leave the employee paying £392.64 in deductions, leaving pay due as £1,607.36. However, as the employer has agreed that the employees net pay should be £2000, this is where a net to gross calculation can be used.

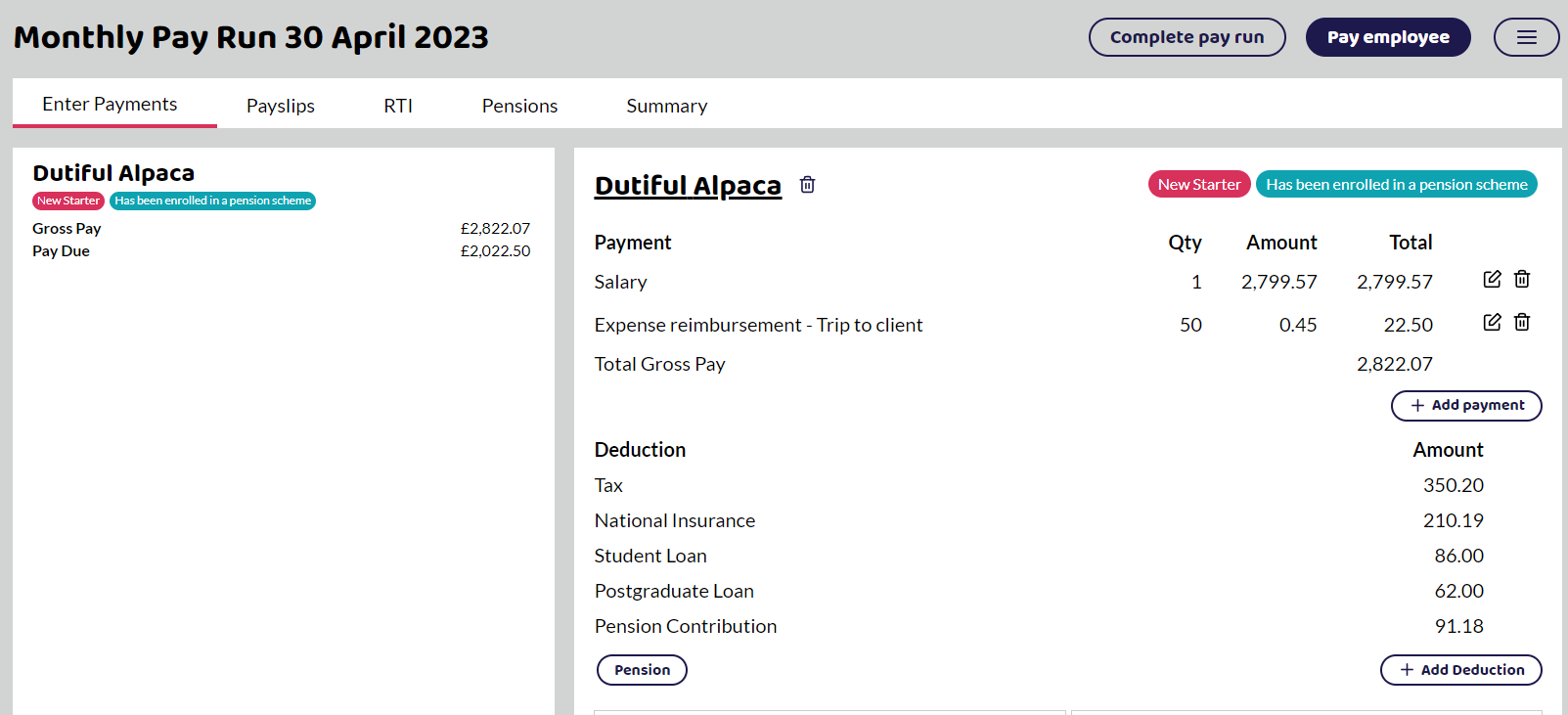

When a net to gross calculation have been applied, the gross pay has been increased to take into account all the deductions so that the employee's net pay is £2000 and the gross pay is now £2,799.57.

Only one net to gross can be made and no other payments can be made to the employee unless they are free of tax, NI and pensions. For example, expenses can be added to the pay.

Available with a paid subscription only.