Employees should receive a payslip every time they are paid on or before they are paid. Shape creates fully compliant payslips every time you pay an employee.

What should be on a payslip?

By law, payslips have to include the following:

Pay before any deductions - 'gross wages'

deductions like tax and national insurance

the employees pay after deductions - 'net pay' - what they will be paid

the number of hours worked, if the pay varies depending on time worked

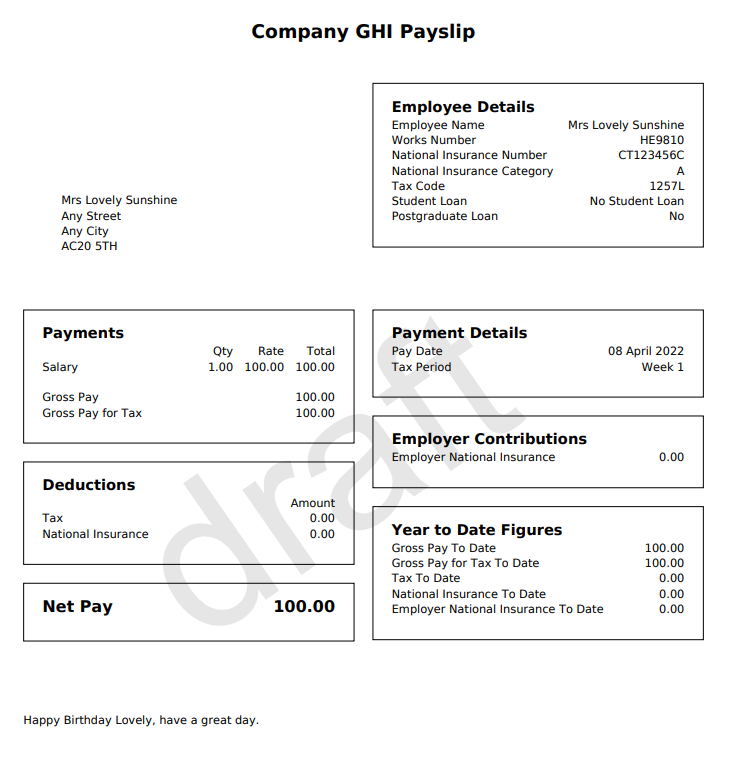

Shape payslips include all the above and also include the following information:

Employee details - tax code, NI category, student loan plan (if applicable)

Employer contributions - national insurance and pensions

Year to date figures so that the employee can see what they have paid and been deducted so far within the employment during the tax year.

How do I create payslips?

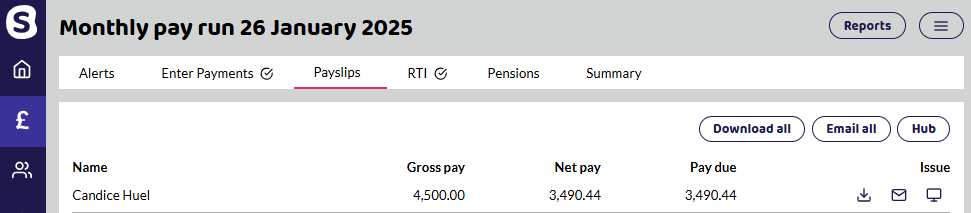

Every pay run, Shape creates payslips as a PDF that can be downloaded, printed, emailed with password protection or employees can log into the Shape Hub to view their payslips themselves.

If the pay run has not been completed, you can download a PDF as a draft. See below for an example of our payslips.

Payslip notes

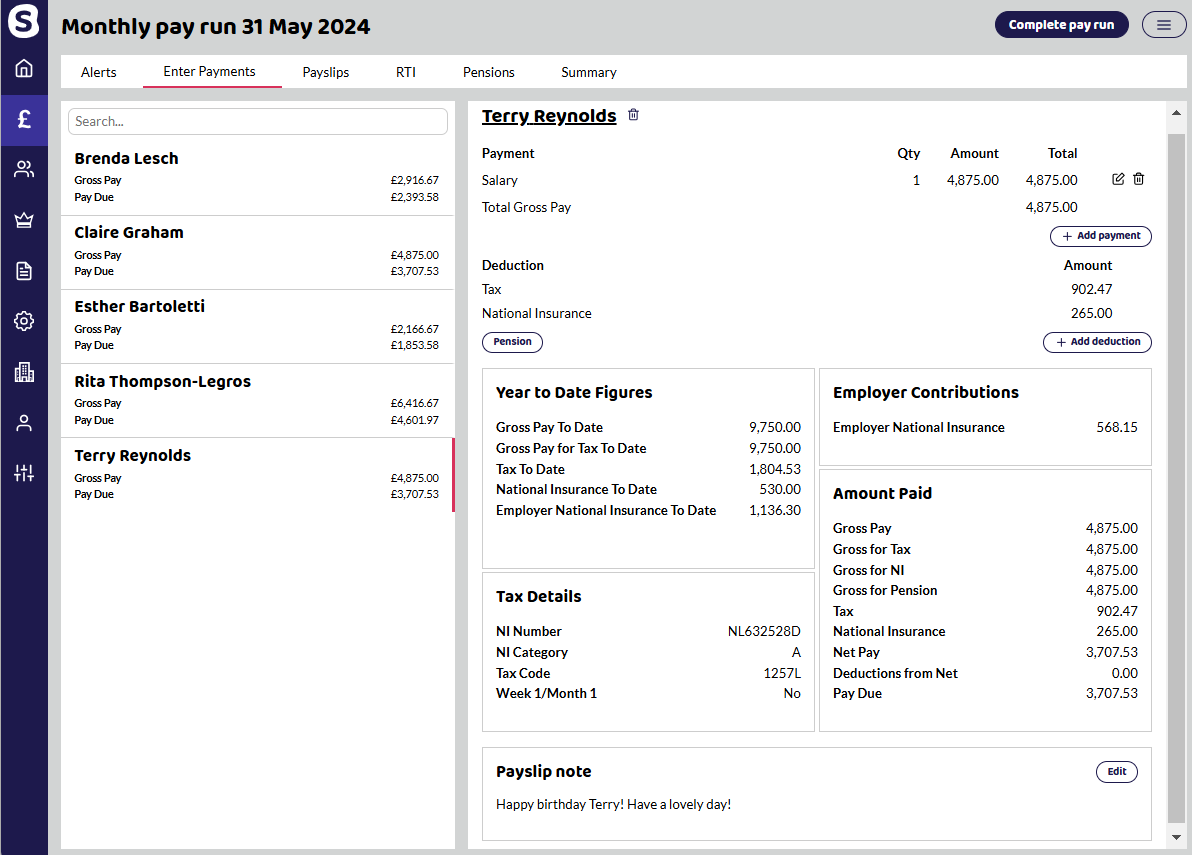

You can add a payslip note. There are 3 ways to add a note to payslips depending on what you want to appear:

All payslips, all the time - Company Setup - in the company setup you can add a note and this will appear on every payslip.

One pay run, all payslips - select the pay run and in the top right hand corner, click the button to get the option Payslip note. This will add a note to all payslips.

Individual payslips - select the employee and at the bottom is a Payslip Notes. Edit to add a message that is only for the employee.

How do I send payslips?

You can download and print payslips or you can use one of the methods below.

Shape Hub

You can invite employees to view their payslips within the Shape Hub using their own login details. See our Shape Hub section for more details. This is the most secure way for employees to receive their payslips and P60s.

Email Payslips

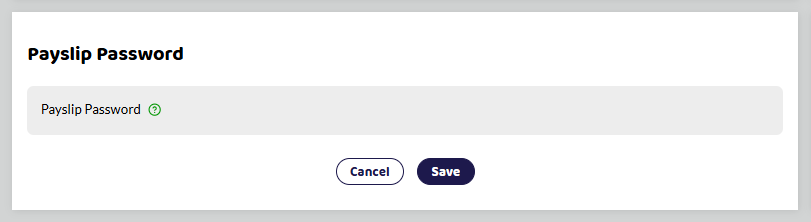

You have the option to email the payslip to the employee straight from the system. When you email the employee, the payslip should be password protected. This is set in the employee details page under Payslip Password.

Once the payslips are emailed you will be able to check the status in the pay run. Green - Sent and received. Red - Bounced. Grey - not sent. Orange - In progress.

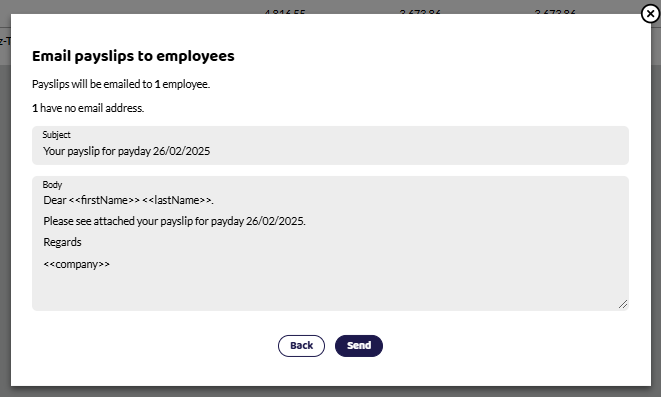

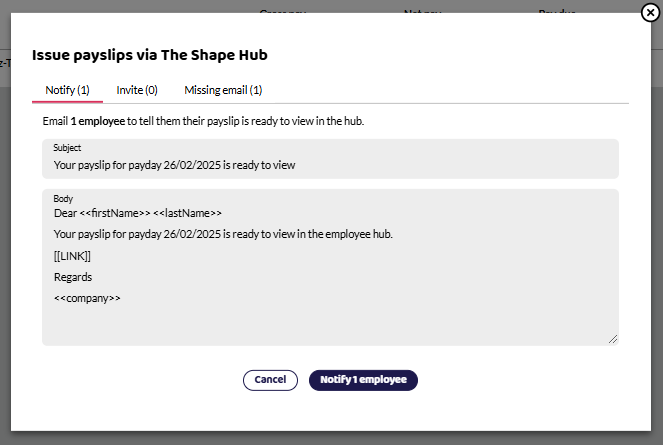

Can I edit the email text?

Yes, you can edit the payslip notification email subject and body before sending to employees. The default text is different when you Email payslips to employees or Issue payslips via The Shape Hub. The test is editable before you click Send or Notify.

Email payslips:

The Shape Hub:

HMRC Further Guidance

Payslips - what information should be on a payslip.