What is Payroll Giving?

Payroll Giving is a way of giving money to charity without paying tax on it. It must be paid through PAYE from someone’s wages or pension. To set up a payroll giving payment in Shape, you need to create a deduction type that is before tax but not national insurance.

Adding a deduction to a pay run

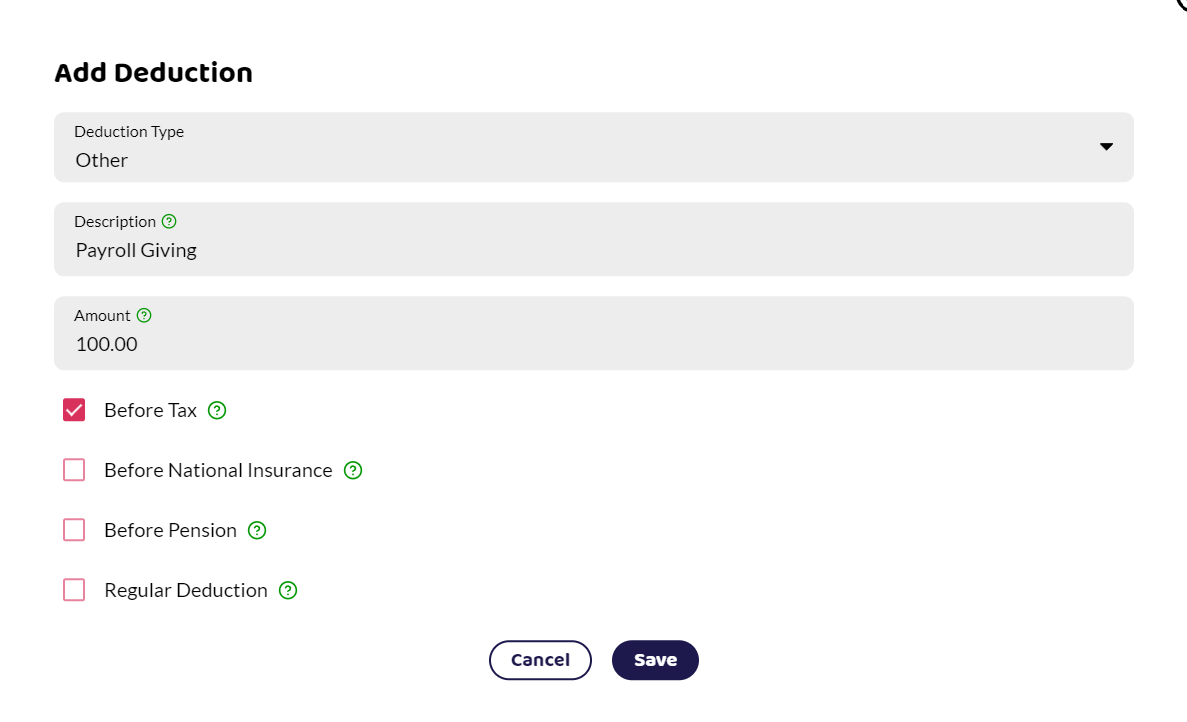

When you do a pay run, select the employee and then add deduction. Select Other. All payment types allow you to edit the description, so you can put either payroll giving or the name of your scheme.

Make sure you check the Before Tax box but leave the Before National Insurance empty. You should also review if payroll giving is before or after pension.

Check the Regular Deduction box if it's a payment that should be made every payment.