When you are migrating payroll software during a tax year, there might be certain figures that need to be carried over:

Employment Allowance Used

Statutory Payments Claimed

Apprenticeship Levy

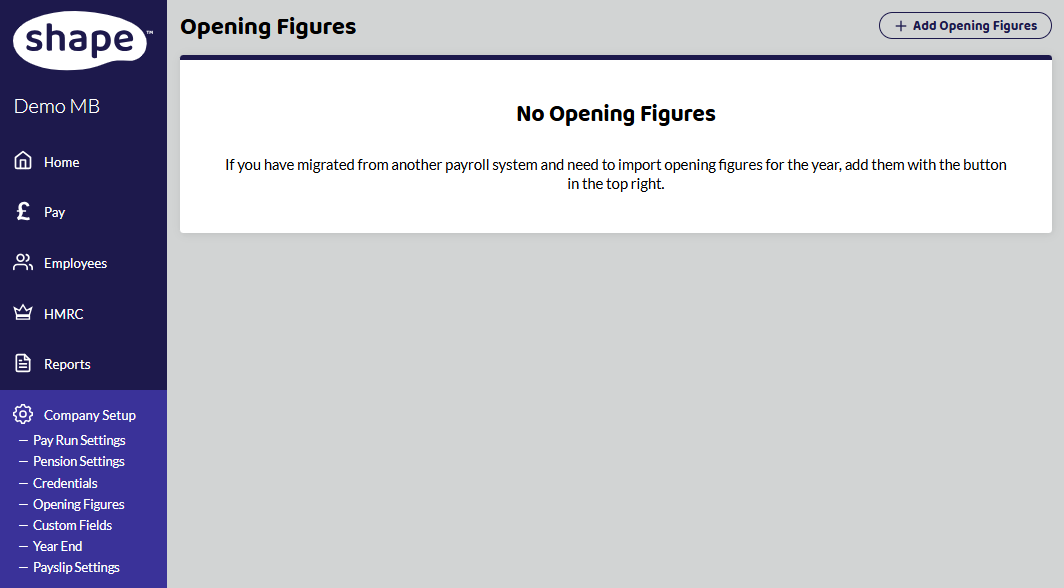

These can be quickly added when setting up your company by going to Company Setup -> Opening Figures.

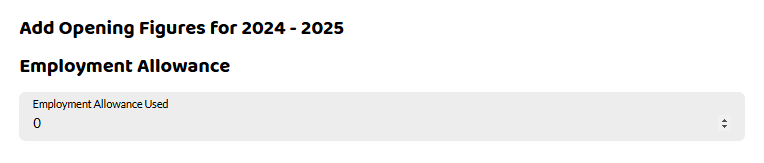

Employment Allowance

If you are eligible for the employment allowance, you may have already claimed some for the current tax year. Here you can enter how much allowance has already been used. This means that Shape won't allocate you more allowance than your company is entitled to for the tax year. Currently, for the 2023-24 tax year, the allowance is £5,000.

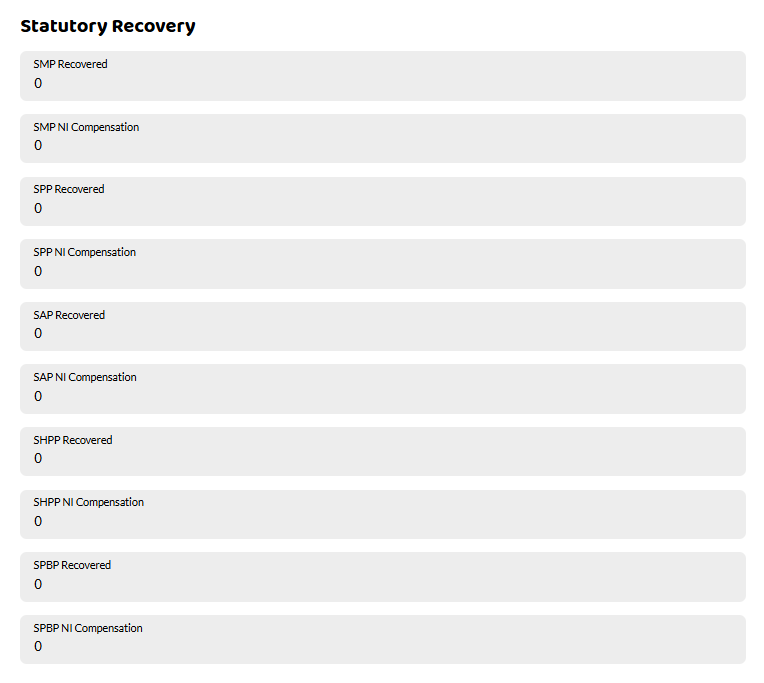

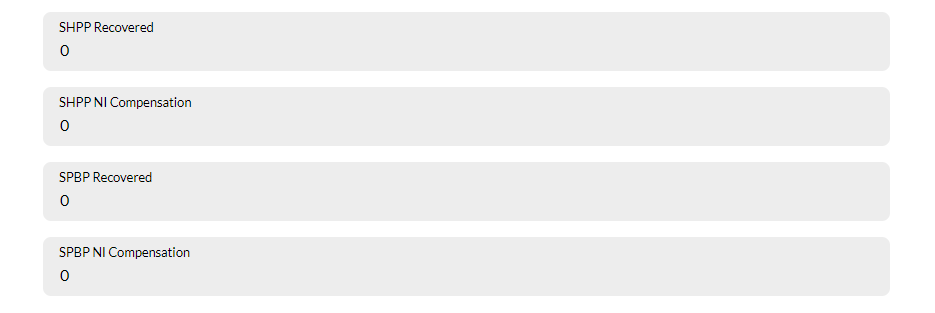

Statutory Payments

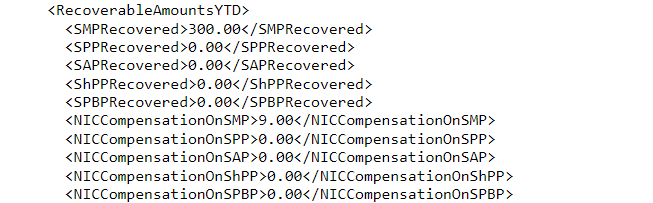

If you have been claiming statutory payments, each time an Employer Payment Summary is sent to HMRC, it includes the year to date figures for the reclaimed amount. Adding them to the opening figures will then add any statutory payments you have previously claimed and continue to add them to any payments you make within the tax year.

You may be able to find this in reports or within the XML of the Employer Payment Summary if you can view it within your old software. Make sure you are reviewing the last EPS submitted.

Make sure you put the correct statutory payment in as shown above. If you are entitled to Small Employers Relief, this is put into the NI Compensation box. Leave any fields not relevant to you as 0. The list below shows the different statutory payments that can be reclaimed:

Statutory Maternity Pay - SMP Recovered

Statutory Paternity Pay - SPP Recovered

Statutory Adoption Pay - SAP Recovered

Statutory Shared Parental Pay - SHPP Recovered

Statutory Parental Bereavement Pay - SPBP Recovered

Statutory Sick Pay cannot be reclaimed.

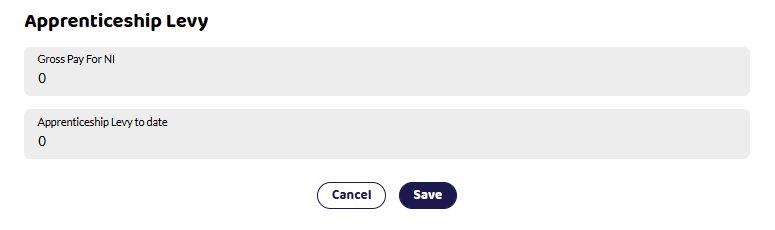

Apprenticeship Levy

You need to find the Gross Pay for NI and the Apprenticeship Levy year to date. Again these figures should be in a report within your payroll software.