You've made all the payments you need to make for the tax year but you aren't seeing the Year End indicator on the homepage. This is because the software is still expecting pay runs and doesn't know you are finished. Forexample, you may have made your last payment in January but will not be making any payments in February or March. In this case, you need to tell the software by forcing the year end.

Force Year End

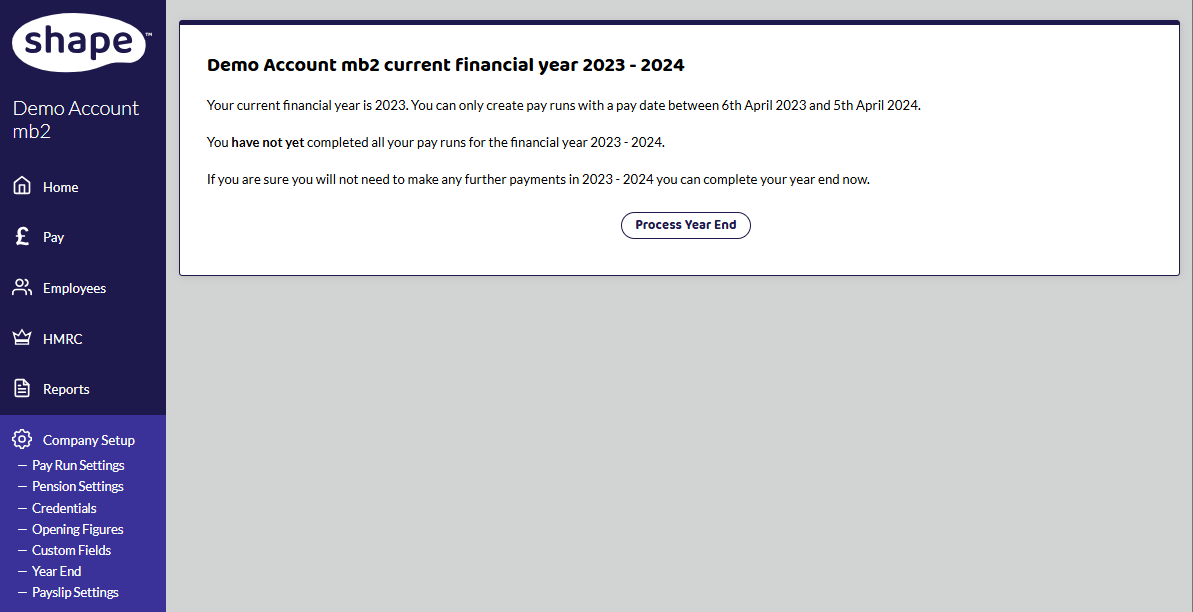

Select Company Setup - Year End and you will see a message warning you that you have not yet completed all your pay runs. If you have, you can ignore this message and press Process Year End.

You can then continue with the Year End process as normal. However, you will be unable to process the year end before the beginning of March as software is updated in line with the new tax year and HMRC guidance.