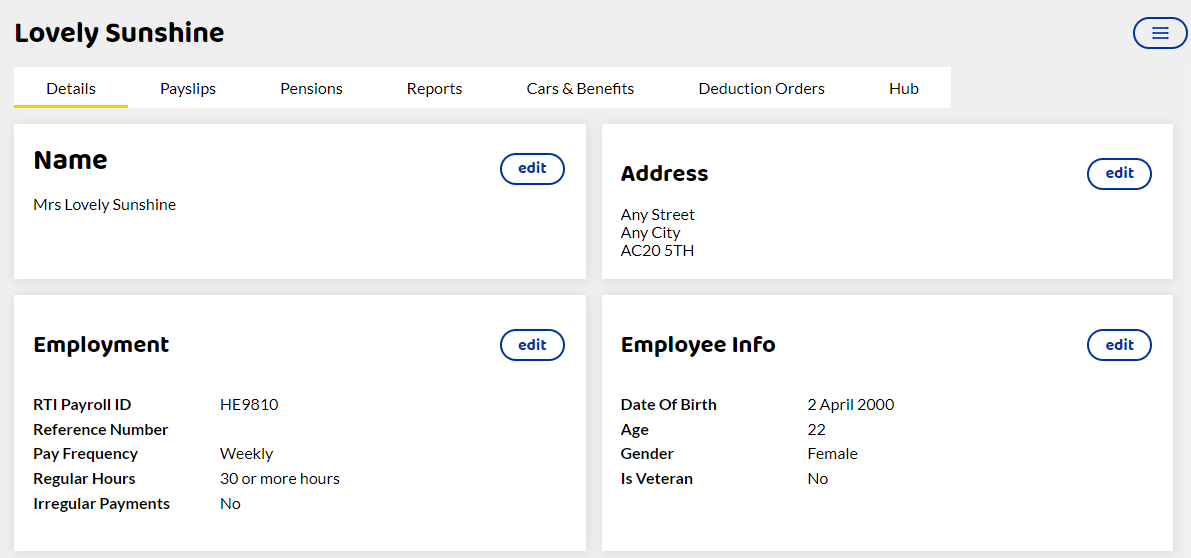

If you need to update an employees details, maybe because they have a new address, email or even a tax code or student loan change, this is done through the employees page. Select the employee and edit the section required. For more information on how to fill out employee details when adding a new employee, please see Starter Wizard.

Within the employee details main page you can edit the following:

Name

Address

Under the following:

Employment

RTI Payroll ID - HMRC use this reference and is supplied on the FPS.

Reference Number - company reference only.

Pay Frequency - How often the employee is paid.

Regular Hours - You need to declare how many hours an employee works a week.

Irregular Payments - for employees not paid on a regular basis.

Employee Info

Date of birth

Gender - male or female options only.

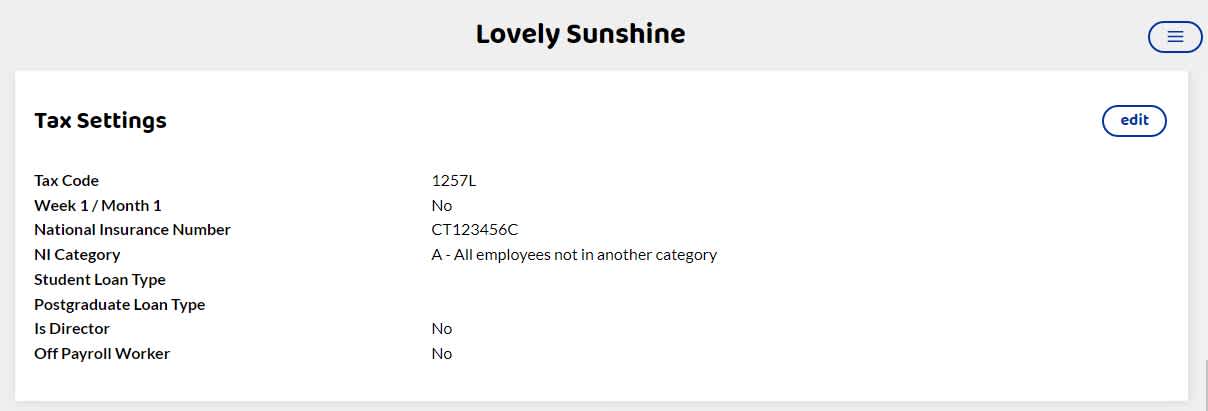

Tax Settings

Tax Code - can be edited if you receive a notice from HMRC or receive a P45 late.

Week 1 / Month 1 - select this box if the tax code has an X at the end.

National Insurance Number (NINO) - If the employee is waiting for their NINO, leave this blank and then add when they receive it. Do not make up a number.

Off-payroll worker

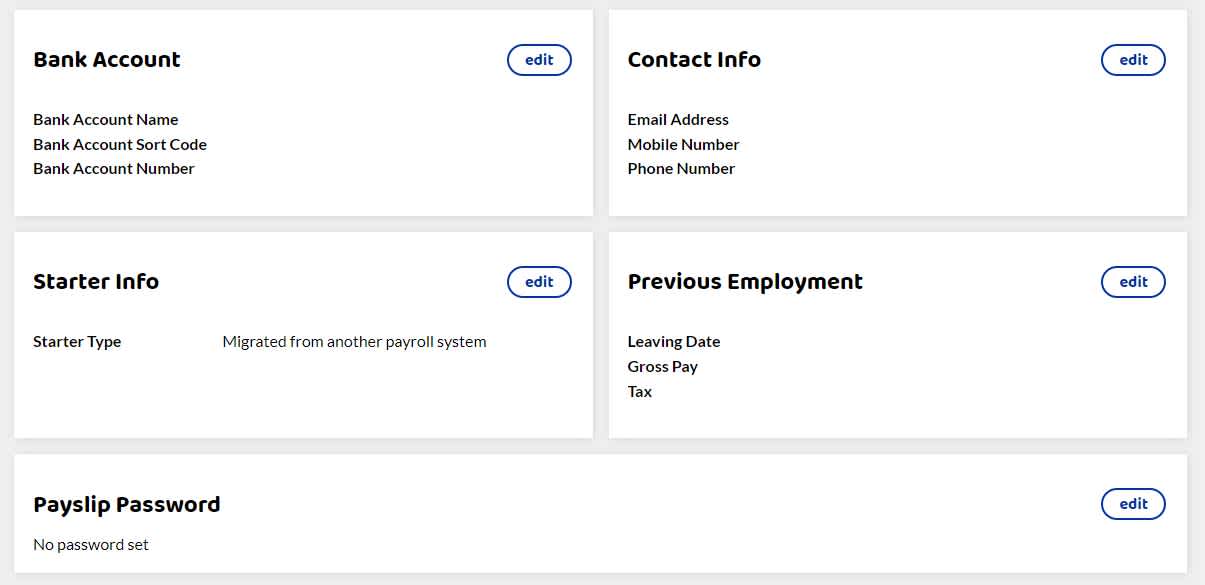

Bank Account

This is used for your reference only. Shape does not make payments to your employee.

Name

Sort code

Account Number

Contact Info

Email Address - used for either emailing payslips or the Shape Hub.

Mobile Number - for your reference only.

Phone Number - for your reference only.

Starter Info

New starter

Previous Employment

If you have been given a P45 or values from HMRC.

Leaving Date

Gross Pay

Tax

Payslip Password

If you are emailing payslips, you should set a password for the employee to use to open the PDF once received. Or you can use the Shape Hub and the employee will have access to a portal that allows them to view all their payslips and P60s.