You can change employee's pension contribution in two ways:

Permanent pension contribution change

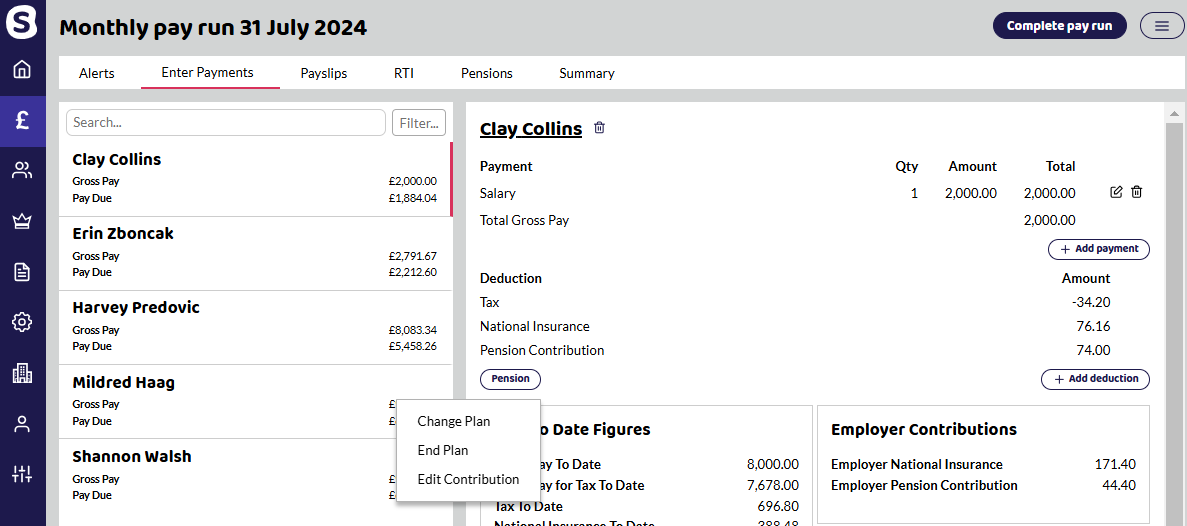

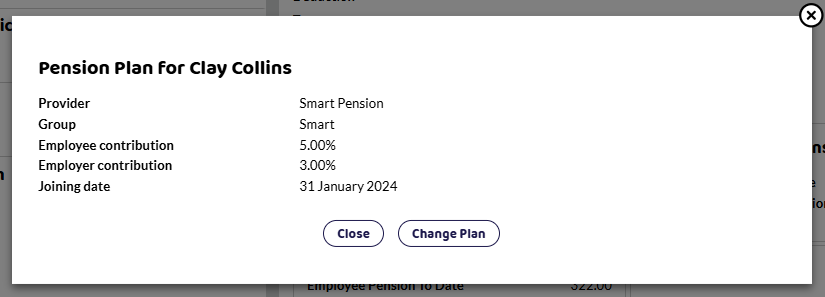

Please go to the employee in the current pay run and click on Pension, then Change Plan.

Click on Change Plan

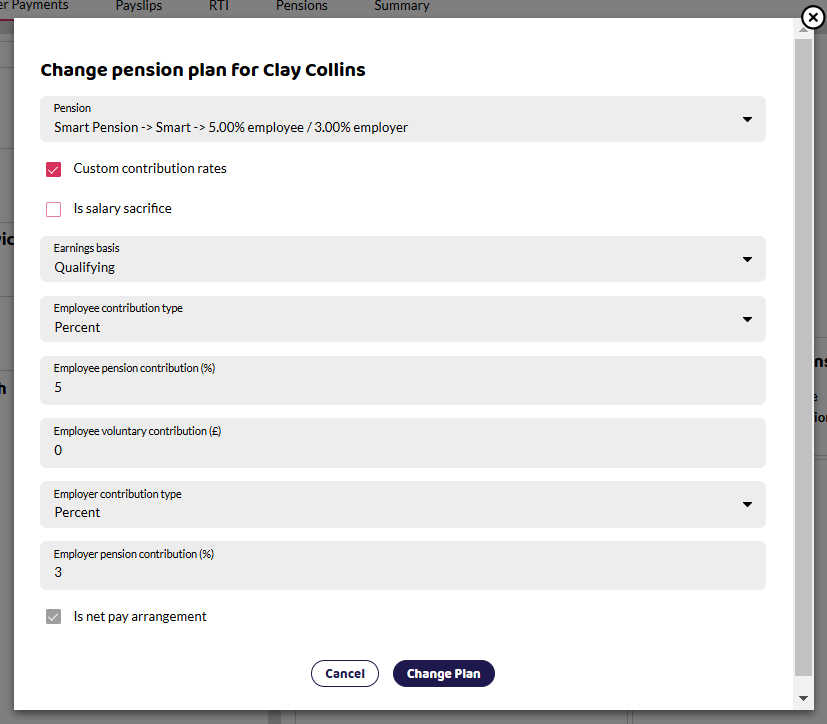

Once you tick the Custom contribution rates box, the editable contribution fields will appear. You can either change the % or change the Employee/ Employer contribution type to Fixed Amount and enter the fixed value instead.

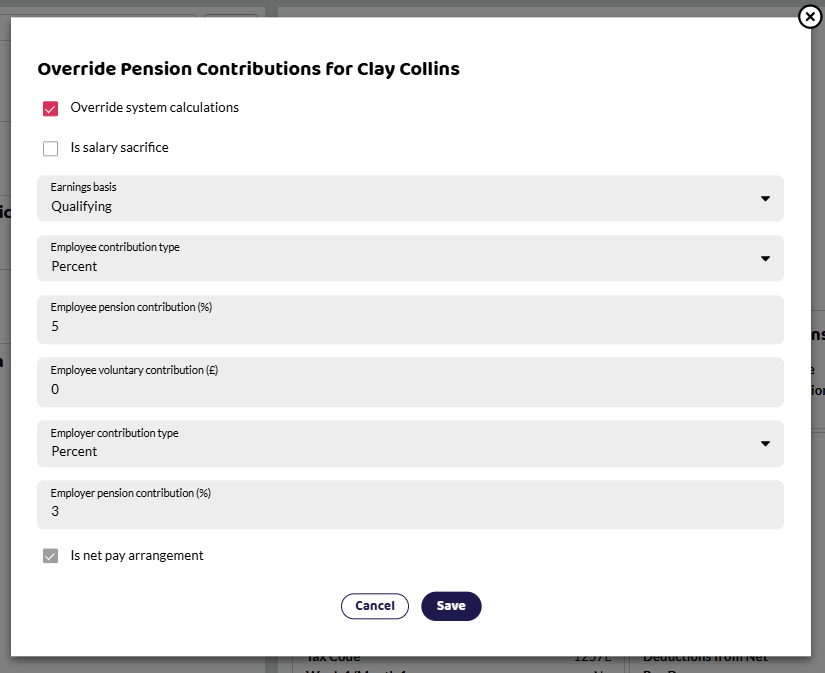

One off pension contribution change (current pay run only)

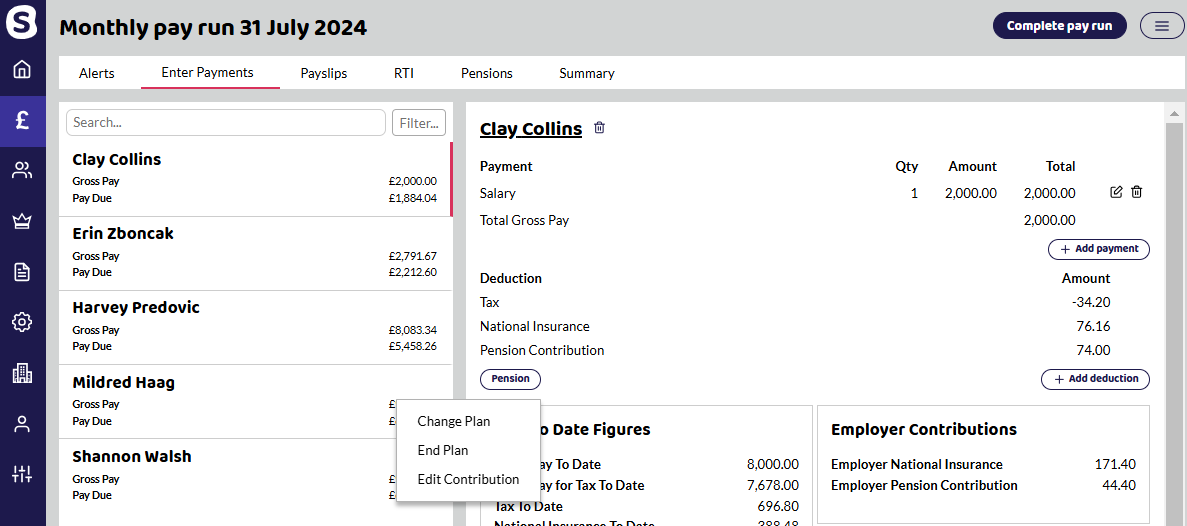

Please go to the employee in the current pay run and click on Pension, then Edit Contribution.

Once you tick the Override system calculations box, the editable contribution fields will appear. You can either change the % or change the Employee/ Employer contribution type to Fixed Amount and enter the fixed value instead.

If the employee isn't showing in the current pay run, please refer to Pay an employee section and ensure the employee is being paid so, the pension can be deducted.

If you have multiple employees with different contributions than the default, it might be worth creating an additional contribution group in Company Setup > Pension Settings.