What is automatic enrolment?

Due to the Pensions Act 2008, from October 2017, all employers must legally assess their employees, put them into a pension scheme if they qualify and contribute to the scheme. This is called 'automatic enrolment'. Even if you only have one employee, you may need to set up a pension scheme and auto enrol them.

How do I know if I need to auto enrol my employees?

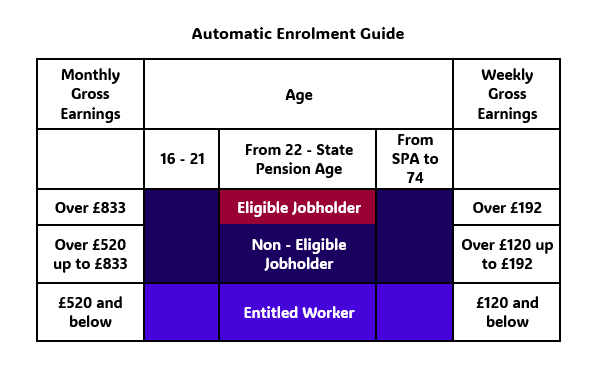

There are different categories that employees or workers fall into:

Eligible jobholders (automatically enrolled) must be enrolled into a pension scheme that is used for automatic enrolment and regular contributions are paid.

Non-eligible jobholders (opt-in) have the right to opt-in to a pension scheme. The employer must then put them into a pension scheme that is used for automatic enrolment and make regular contributions.

Entitled workers can ask to join a pension scheme and the employer has to provide a pension scheme for them but the employer does not have to pay contributions.

The table above shows the monthly and weekly thresholds for assessing an employee in the 2024-2025 tax year. This criteria is the same as the 2021-2022, 2022-2023 and 2023-2024 tax year.

Employees that have annual earnings above £10,000 (£833 per month/£192 per week) and are between 22 and state pension age are classed as Eligible Jobholders.

Employees that have annual earnings over £6,240 (£520 per month/£192 per week) up to £10,000 and are 16-21 or State Pension age up to 74 are classed as Non-eligible Jobholders. Any employees who are 16-21 or State Pension Age up to 74 and earning above the £10,000 threshold are also classed as Non-eligible Jobholders.

Any employees earning up to the annual threshold of £6,240 are classed as Entitled Workers.

What are Qualifying Earnings?

Contribution amounts for an automatic enrolment pension scheme are based on annual earnings. These can be made up of salary, wages, overtime, commissions, bonuses and statutory pay and will depend on the type of pension scheme that is set up.

Earnings between £6,240 and £50,270 are classed as qualifying earnings and are what the minimum contribution rates have to be based on.

Contribution Rates

From April 2019 the contribution rate percentage of qualifying earnings must be at least 8%. The employer has to contribute a minimum of 3% of that 8%. This leaves the employee contributing 5%. Some employers may contribute more and reduce what the employee needs to contribute.

Date | Employer minimum contribution | Employee contribution | Total contribution |

|---|---|---|---|

From April 2019 | 3% | 5% | 8% |

When do I enrol employees?

Employers must assess and enrol an employee from the first time they pay them if they meet the criteria set out above. If the employee's wages fall below £120 per week or £520 per month, then the employer may stop paying contributions but this depends on the pension scheme.

An employee receives a bonus, do I need to enrol them?

If the employee receives a bonus that pushes them over the threshold, then they need to be enrolled in that week or month. You can find more information on the Pensions Regulator website on employing staff on irregular hours or incomes.

How does Shape help with automatic enrolment?

Please see Automatic enrolment in Shape for further details.

Further guidance

If you need to set up a scheme, you should consult a pension advisor. The pensions regulator has lots of information that will also support you.

Pension Regulator - Employers